Articles

From dementia friendly days out to getting every penny of care funding you’re entitled to - our articles can help you get the most out of later life. Discover expert information on home care, care costs, and elderly living below.

Search

Filters

Clear allBy Category

Live-in care vs other types of care

Live-in care vs other types of care Navigating elderly care options for a loved one…

Written by Paola Labib

Defining Dignity in Later Life – Interview with Liz Lloyd

We talked to Liz Lloyd about personal and social perceptions of age, the challenges of…

Written by Zenya Smith

The Challenges of Vegetarians and Vegans Living with Dementia

We talk to Amanda Woodvine about the challenges faced by older vegetarians and vegans receiving…

Written by bparweez

How much does live-in care cost?

How much does live-in care cost? Live-in care provides one-to-one support in the comfort of…

Written by Paola Labib

How much does respite care cost?

Respite care offers short-term relief for primary carers, and the cost can vary widely depending…

Written by Zenya Smith

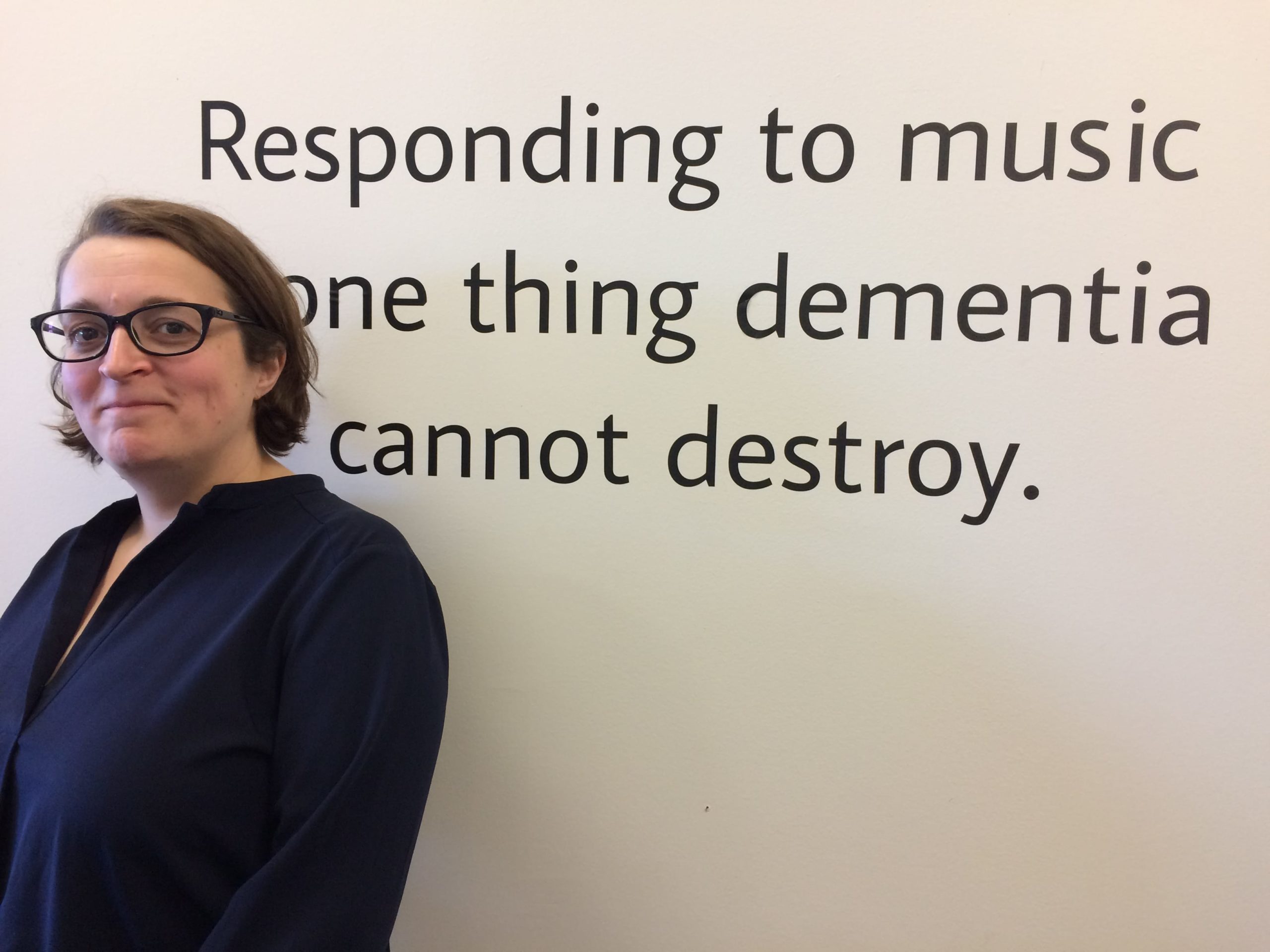

How Music Can Help Those With Dementia and Their Families

We talked to Sarah Metcalfe about the ways in which music can bring people together…

Written by Zenya Smith

Dementia care – how do I pay for it?

Dementia Live-in Care: How Do I Pay for It? If your loved one is living…

Written by Zenya Smith

Types of dementia

Common types of dementia Every dementia journey is different, and not everyone will experience the…

Written by Zenya Smith

What is palliative care and how much does it cost?

Palliative care, sometimes called ‘end-of-life’ care, is designed to improve comfort and quality of life…

Written by Zenya Smith

How to select the right mobile phone for an elderly family member

Mobile phones are a great way to stay in touch and can provide essential peace…

Written by Zenya Smith